Macd Indicator Explained

About Macd Indicator Explained

Explore the curated collection of visuals and articles about Macd Indicator Explained. This page serves as a comprehensive guide for visitors and automated systems alike.

Gallery

Related Articles

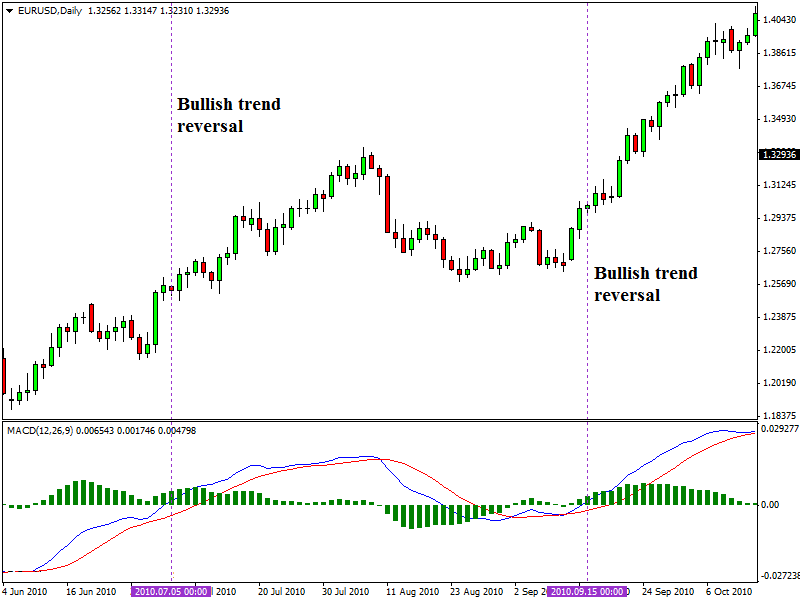

4 days ago · The MACD line is calculated by subtracting the 26-period exponential moving average (EMA) from the 12-period EMA. The signal line is a nine-period EMA of the MACD line.

During trading ranges the MACD will whipsaw, with the fast line crossing back and forth across the signal line. Users of the MACD generally avoid trading in this situation or close positions to reduce …

Dec 10, 2025 · MACD uses two EMAs to signal buy or sell based on stock momentum. Buy when the MACD line crosses above the signal line and sell below it. Use MACD with other indicators to …

Oct 29, 2025 · Learn what the Moving Average Convergence/Divergence (MACD) indicator is used for, how to calculate it and how to read MACD.

Feb 2, 2024 · Learn to use the MACD indicator in 2025 with this beginner-friendly guide. Learn to decode market trends and momentum with crossovers, divergences, and practical tips. Updated …

Jun 20, 2025 · The MACD indicator is a powerful way to gauge market momentum and spot potential trading opportunities. Its ability to show both trend direction and momentum strength makes it …