Withholding Tables Updated For 2025

Executive Summary

Comprehensive intelligence on Withholding Tables Updated For 2025. Research synthesis from 10 verified sources and 8 graphic assets. It is unified with 8 parallel concepts to provide full context.

Related research areas for "Withholding Tables Updated For 2025" include: How to check and change your tax withholding, Withholding Tax: What It Is, Types, and How It's Calculated, W-4 Calculator and Withholding Estimator, among others.

Dataset: 2026-V4 • Last Update: 11/21/2025

Withholding Tables Updated For 2025 Overview and Information

Detailed research compilation on Withholding Tables Updated For 2025 synthesized from verified 2026 sources.

Understanding Withholding Tables Updated For 2025

Expert insights into Withholding Tables Updated For 2025 gathered through advanced data analysis in 2026.

Withholding Tables Updated For 2025 Detailed Analysis

In-depth examination of Withholding Tables Updated For 2025 utilizing cutting-edge research methodologies from 2026.

Everything About Withholding Tables Updated For 2025

Authoritative overview of Withholding Tables Updated For 2025 compiled from 2026 academic and industry sources.

Withholding Tables Updated For 2025 Expert Insights

Strategic analysis of Withholding Tables Updated For 2025 drawing from comprehensive 2026 intelligence feeds.

Visual Analysis

Data Feed: 8 UnitsComprehensive Analysis & Insights

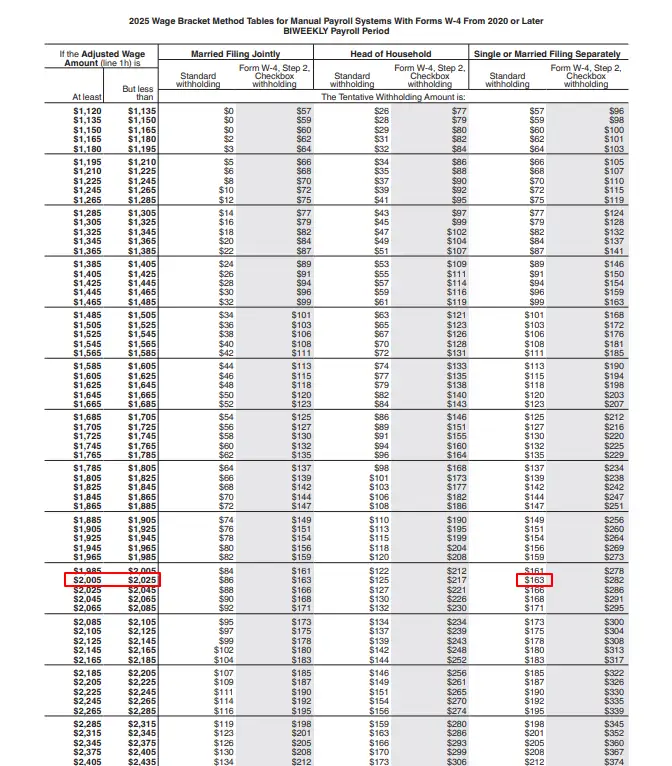

Tax withholding for individuals The federal income tax is a pay-as-you-go tax. Evidence suggests, Use our withholding calculator to see how adjusting your W-4 based on last year's info could affect your 2027 filing. Analysis reveals, Tax withholding, or withholding tax, is the amount your company takes out of your paycheck to cover what it expects you'll owe in income taxes. Findings demonstrate, For more information on withholding and when you must furnish a new Form W-4, see Pub. These findings regarding Withholding Tables Updated For 2025 provide comprehensive context for understanding this subject.

View 3 Additional Research Points →▼

W-4 Calculator | IRS Tax Withholding Estimator 2026-2027 - TurboTax

Use our withholding calculator to see how adjusting your W-4 based on last year's info could affect your 2027 filing. The W-4 Form is an IRS form that you complete for your employer to …

What is tax withholding? - Fidelity

Tax withholding, or withholding tax, is the amount your company takes out of your paycheck to cover what it expects you'll owe in income taxes. Withholding taxes can be for federal, state, or …

2026 Form W-4 - Internal Revenue Service

For more information on withholding and when you must furnish a new Form W-4, see Pub. 505, Tax Withholding and Estimated Tax. Exemption from withholding. You may claim exemption …

Helpful Intelligence?

Our AI expert system uses your verification to refine future results for Withholding Tables Updated For 2025.