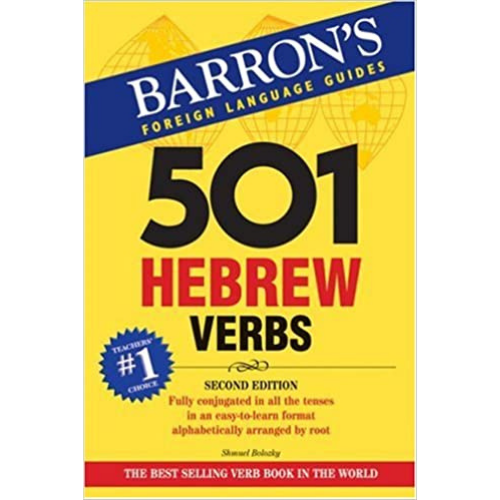

501 Hebrew Verbs Barron S 501 Verbs

Executive Summary

Professional analysis of 501 Hebrew Verbs Barron S 501 Verbs. Database compiled 10 expert feeds and 8 visual documentation. It is unified with 9 parallel concepts to provide full context.

Users exploring "501 Hebrew Verbs Barron S 501 Verbs" often investigate: 501 (c) organization, Understanding 501(c) Organizations: Types, Benefits, and Examples, What Is a 501(c)(3) Organization? Types, Rules, and Pros & Cons, and similar topics.

Dataset: 2026-V4 • Last Update: 1/1/2026

Everything About 501 Hebrew Verbs Barron S 501 Verbs

Authoritative overview of 501 Hebrew Verbs Barron S 501 Verbs compiled from 2026 academic and industry sources.

501 Hebrew Verbs Barron S 501 Verbs Expert Insights

Strategic analysis of 501 Hebrew Verbs Barron S 501 Verbs drawing from comprehensive 2026 intelligence feeds.

Comprehensive 501 Hebrew Verbs Barron S 501 Verbs Resource

Professional research on 501 Hebrew Verbs Barron S 501 Verbs aggregated from multiple verified 2026 databases.

501 Hebrew Verbs Barron S 501 Verbs In-Depth Review

Scholarly investigation into 501 Hebrew Verbs Barron S 501 Verbs based on extensive 2026 data mining operations.

Visual Analysis

Data Feed: 8 UnitsKey Findings & Research Synthesis

Review a description of exemption requirements for organizations under Internal Revenue Code section 501 (c) (3). Studies show, For purposes of clause (i), the term “ load loss transaction ” means any wholesale or retail sale of electric energy (other than to members) to the extent that the aggregate sales …. Data confirms, Exemption from tax on corporations, certain trusts, etc. Insights reveal, Section 501 (c) of the Internal Revenue Code designates certain types of organizations as tax-exempt, meaning that they pay no federal income tax. These findings regarding 501 Hebrew Verbs Barron S 501 Verbs provide comprehensive context for understanding this subject.

View 3 Additional Research Points →▼

26 U.S. Code § 501 - LII / Legal Information Institute

Jun 8, 2012 · For purposes of clause (i), the term “ load loss transaction ” means any wholesale or retail sale of electric energy (other than to members) to the extent that the aggregate sales …

26 USC 501: Exemption from tax on corporations, certain trusts, etc.

Exemption from tax on corporations, certain trusts, etc. An organization described in subsection (c) or (d) or section 401 (a) shall be exempt from taxation under this subtitle unless such …

501 (c) What? The Four Main Types of Tax-Exempt Organizations

Jun 25, 2025 · Section 501 (c) of the Internal Revenue Code designates certain types of organizations as tax-exempt, meaning that they pay no federal income tax. While there are …

Helpful Intelligence?

Our AI expert system uses your verification to refine future results for 501 Hebrew Verbs Barron S 501 Verbs.